For medical device developers seeking to enter the diverse, complex Asia-Pacific (APAC) market, having a well-planned reimbursement strategy is critical for commercial success. Thoughtful consideration of coverage, coding, and payment should be factored into the product development cycle at its earliest stages, and understanding the reimbursement landscape in all the countries in which you intend to commercialize is essential.

Public and private healthcare funding in the APAC region

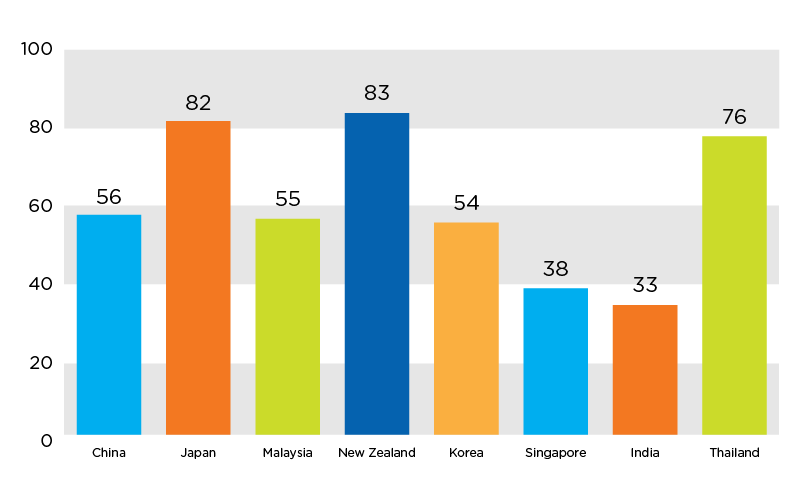

Approximately 45 percent of healthcare funding in the APAC region comes from the public sector; however, this represents a blend of countries like Japan, where the government bears over 80 percent of total spending, and India, where the government bears 33 percent of total spending. 1 Private health insurance in the APAC region is growing at 14.8 percent per year as third-party payers move to provide broader access to care and private sector alternatives to nationalized systems.

Figure 1. Government contribution to total healthcare expenditures in select APAC countries (2012) 1

Escalating healthcare costs have prompted payers and purchasing departments to scrutinize device costs. Consequently, it is critical for sponsors to include health economic data and market assessments in their clinical trial designs. Where possible, study protocols should capture cost-effectiveness data, which helps address potential questions as to whether the device provides economic benefits compared to already-available therapies or the standard of care

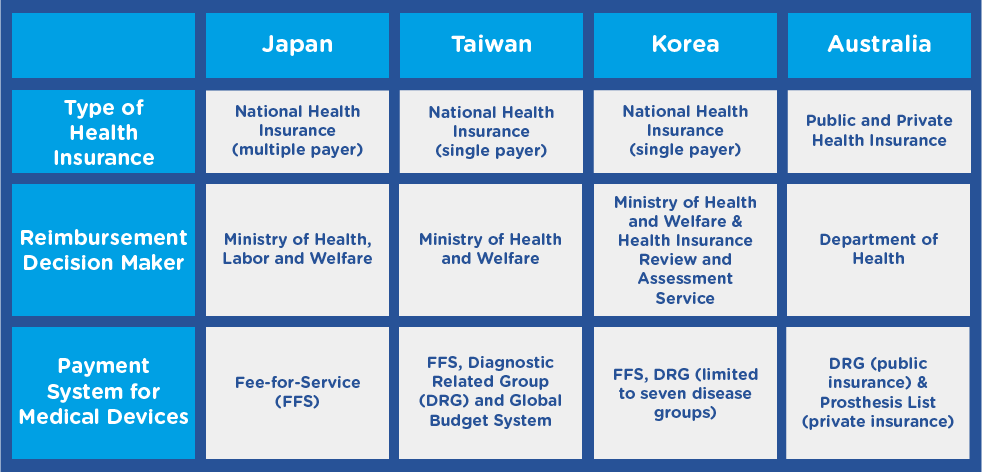

Rules for reimbursement in select APAC countries

Device reimbursement procedures vary across APAC countries and are usually complicated. Generally, APAC countries manage device reimbursement using a functional category system, where devices are grouped based on similarity in structure, intended use, efficacy and performance. In addition, APAC governments tend to maintain price equilibrium within the product range, regardless or added features or improved efficacy. For device manufacturers, optimizing innovation and price requires not only having knowledge of the official reimbursement procedures, but also understanding the government’s broader healthcare goals.

Figure 2. Comparison of healthcare systems in select APAC countries 2

Adapted from Lee SS, Symonds D, Kamogawa S, et al. Reimbursement coverage and pricing systems for single-use devices in Asia-Pacific: Japan, Taiwan, Korea and Australia compared. Value Health Reg Issues 2015;6:126-129.

Japan

In Japan,nearly all medical devices sold are paid for by the country’s National Health Insurance (NHI) system, and reimbursement is complicated.3 Whereas some devices are reimbursed indirectly through procedure fees, others are reimbursed based on global prices. Japan has various reimbursement classes:

- A & B – for already-categorized medical devices

- C – for new medical devices, sub-categorized into C1 for new products based on existing therapies/procedures and C2 for new products arising from a new therapy or procedure

- F – for devices that do not fit into a reimbursement category and will not be reimbursed

Reimbursement rates may be higher for new technologies, but reimbursement negotiations do not occur until nine months after the device is approved. 4

Taiwan

The National Healthcare Insurance Program, the universal healthcare system of Taiwan, is regulated by the Bureau of National Health Insurance (BNHI), which determines prices for new devices by comparing them with similar products on the market. For novel devices, the BHNI examines existing prices in other countries.

Korea

Under the regulations set by Korea’s Ministry of Health and Welfare (MOHW) and Health Insurance Review Agency (HIRA), medical devices are grouped with predicate products and given the lowest price among existing predicates. For novel products, HIRA may determine a new reimbursement price comparable to or less than the price in countries where the device has already been approved.

Australia

Australia’s national health system reimburses medical devices using Diagnostic Related Group (DRG)-based prospective case payments. In the private health insurance system, only devices listed on the Prostheses List, a device register administered by the Department of Health, are reimbursed. 2

China

In China, reimbursement may vary among provinces or even cities. The medical insurance system is largely run by the government and, in order to be reimbursable, a device must be on the Medical Insurance Reimbursement Lists.

Key Takeaway

It is important to understand—and plan for—nuances in the reimbursement landscapes of Asian healthcare systems. Collaborating with strategic partners who have device expertise and local know how can help ensure that there is market demand and a clear path to reimbursement. To learn more, download our white paper here.

1 World Health Organization. WHO Global Health Expenditure Atlas, September 2014. https://www.who.int/health-accounts/atlas2014.pdf. Accessed October 23, 2019.

2 Lee SS, Symonds D, Kamogawa S, et al. Reimbursement coverage and pricing systems for single-use devices in Asia-Pacific: Japan, Taiwan, Korea and Australia compared. Value Health Reg Issues 2015;6:126-129.

3 World Health Organization. Global Health Expenditure Database. Accessed October 23, 2019.

4 MedTech Intelligence. Strategies for Success in Japan’s Medical Device Market. MedTech Intelligence website. Published March 7, 2018. https://www.medtechintelligence.com/column/strategies-success-japans-medical-device-market/. Accessed October 23, 2019.